It’s our business to protect your business.

David G. Sayles Insurance

Services:Your Trusted Insurance Partner

Tailoring Your Coverage to Your General Liability Needs

Risk is an inherent part of running a business and moving it profitably forward, whether it’s to expand by opening another location, adding more staff, or developing new products and services. With this risk comes the need to properly safeguard your assets to continue on your road to success. Our staff at David G. Sayles Insurance Services is committed to helping companies like yours protect the value of your business with insurance protection designed to address complex and diverse liability exposures.

Our general liability insurance policy, of course, will provide coverage in the event visitors to your business – whether you are a storefront, office or manufacturing operation – are injured on your premises or there is damage to their property. It will also provide for allegations of libel or slander for which you are legally liable.

Yet, we go beyond the basic policy. We will conduct a top-to-bottom assessment of your operations to get a full picture of where your liability exposures lie. You may have pollution liability risks, for example, that need to be a part of your insurance protection. As a manufacturer, for instance, you will have product liability risks to address. Importers and exporters have a similar exposure, in addition you may have a professional liability exposure typically not covered under general liability insurance and requires a specific E&O policy. Non-profits can be the target of sexual and abuse liability claims, which without specific coverage for these types of allegations, would not be covered.

Working together with you, we will address not only your general liability exposures but also specific risks unique to your business and industry. We will also assist you in determining how much coverage you need to avert being underinsured. Commercial umbrella insurance will be a part of our discussion when reviewing your needs.

Addressing Additional Liability Risks

No insurance discussion is complete without addressing some other key exposures your business faces and the solutions to protecting against these risks, including:

- Employment Practices Liability – employee-related claims involving allegations of discrimination, sexual harassment, wrongful termination, wage-and-hour disputes, among others

- Directors and Officers Liability – involving allegations of wrongdoing or negligence on the part of directors, officers and management of a company

- Cyber Liability – increased cyber threats involving data breaches and network security compromises today affect all business large and small

- Professional Liability – involving allegations of errors and omissions on the part of a professional’s performance or lack of performance that result in financial damage to a client

At David Sayles Insurance Services, we also provide customizable policies that can cover rental car costs while your vehicle or the other party’s car is in the shop, emergency aid, and legal expenses. Our umbrella insurance policies can be applied to your liability for vehicular accidents if your auto insurance liability limits are not enough in a specific incident.

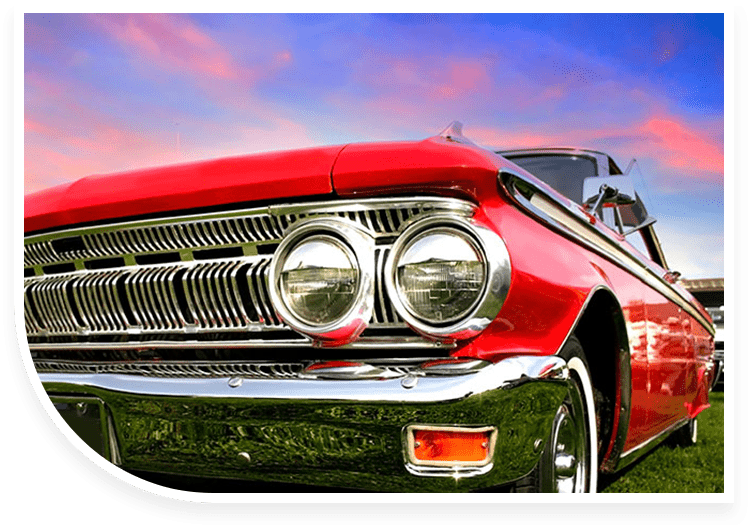

Under the Hood of Our Classic Car

We understand as an owner of a classic and collector car, this is your baby, which requires exceptional coverage and services especially designed for these types of vehicles. We work with insurers that provide custom-made policies for classic and antique cars. They are designed to provide:

- Agreed Value that can increase with the value of your car – get the exact amount agreed to if the vehicle is totaled, with no surprises

- Your Choice of Body Shop

- No Mileage Restrictions

- Coverage for Newly Acquired Autos Worldwide

- Coverage for Vehicles in Restoration

- Inflation Guard

- Towing and Labor

We can also provide medical reimbursement for insured injuries at auto shows and coverage for spare parts under comprehensive insurance. In addition, the claims specialists and adjusters at the insurance companies with which we secure coverage are well schooled in the nuances of collector vehicles. You can be assured of being well protected and well served.

We also offer package policies, including Business Owners Policies and Commercial Package Policies, and will be happy to review and determine which is right for your company and industry sector. Our current clients

include importers & exporters, wineries &

breweries, manufacturers, and non-profits, to

name a few.

We’re always

accountable to you.

Let David Sayles Insurance Services help you with your insurance program. Our unique talented and experienced team of professionals is ready to provide you with the service you deserve and the insurance you need. Give us a call at 800-439-0292 to go over your specific needs.